Header box

Retailer

We add value for retailers and tourists

Shopping tourism in Germany is very popular by travelers and is booming, thus offering the retailer vast business growing opportunities. Due to various reasons, this potential remains partly unused. Tax Free Germany would therefore like to close this loophole by applying its services, which offer non EU-tourists and retailers a considerable VAT.

Free of charge – Safe – Uncomplicated

Through our services of VAT reimbursement, you as an entrepreneur are relieved of tedious accounting duties, risks and all formalities with the revenue authority. Our voucher corresponds with the customs and revenue authority regulations. We know the rules and regulations concerning Tax Free Shopping and are familiar with all VAT reimbursement procedures.

For that matter we are self-reliant, meaning we regulate all VAT reimbursement procedures in our name and on our account.

Service

Put yourself in a successful position by making use of our promotional advertising tools. Our Tax Free Logo is very clear and draws the customer´s attention to Tax Free Shopping without any misconceptions. Use our free advertising sponsorship to promote the Tax Free Services. We developed unique stickers for windows, doors and stand-up displays for checkout areas in order to make Tax Free Shopping recognized in your shop.

In due course you will realise that involvement in the shopping tourism pays off and that it is going to be the trade turnover generator in the future.

Documents

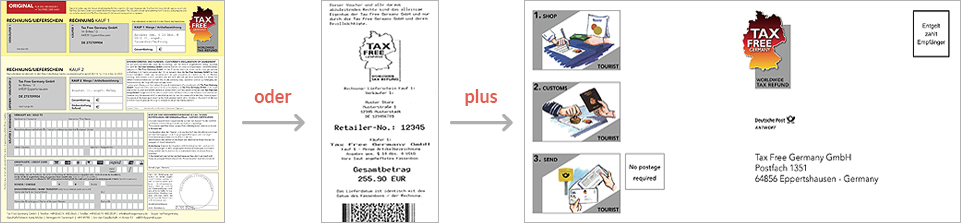

Procedure at the shop – trader

1. With a Tax Free Terminal: Print out the Tax Free eVoucher. The dealer does not have to fill out anything!

1. With a Tax Free Terminal: Print out the Tax Free eVoucher. The dealer does not have to fill out anything!

Without a Tax Free Terminal: Tax Free voucher with the total price and the reimbursement are required to be filled in the blank!

2. Tacker the shopping receipts together with the Tax Free voucher.

2. Tacker the shopping receipts together with the Tax Free voucher.

3. The Tax Free voucher and the receipts will be handed over to the customers along with the pre-franked envelope.

3. The Tax Free voucher and the receipts will be handed over to the customers along with the pre-franked envelope.

Information for tourists on departure

- The customs must confirm the export of goods. This you can do only at the last point where you will leave the EU. Usually this is done at the airport or at the border, for example, Germany – Switzerland. You have to present the purchased goods together with the Tax Free Germany voucher, the original invoice/receipt and your passport to the competent customs office. The customs stamps confirming the export of the goods. Only in combination with the customs stamp will our voucher along with the original invoice become an export document.

- At the airport, the tourist may claim reimbursement at one of the Tax Free Germany cashier locations or the tourist sends the stamped Tax Free voucher, completed with their data (address and signature) along with the original invoice by using one of our postage pre-paid envelopes to the Tax Free Germany headquarters. For this purpose, the credit card number of tourists is required for a transfer, which has to be written down in the voucher. A credit to his/her credit card account is carried out according inbox within three working days.

Be our partner!

Make use of our experience and boost your success with us. Your commitment alone matters, therefore approach us and we will be pleased to advise you.

Magazine about culture, fashion, shopping and trends.Tax Free Magazine

Magazine about culture, fashion, shopping and trends.Tax Free Magazine