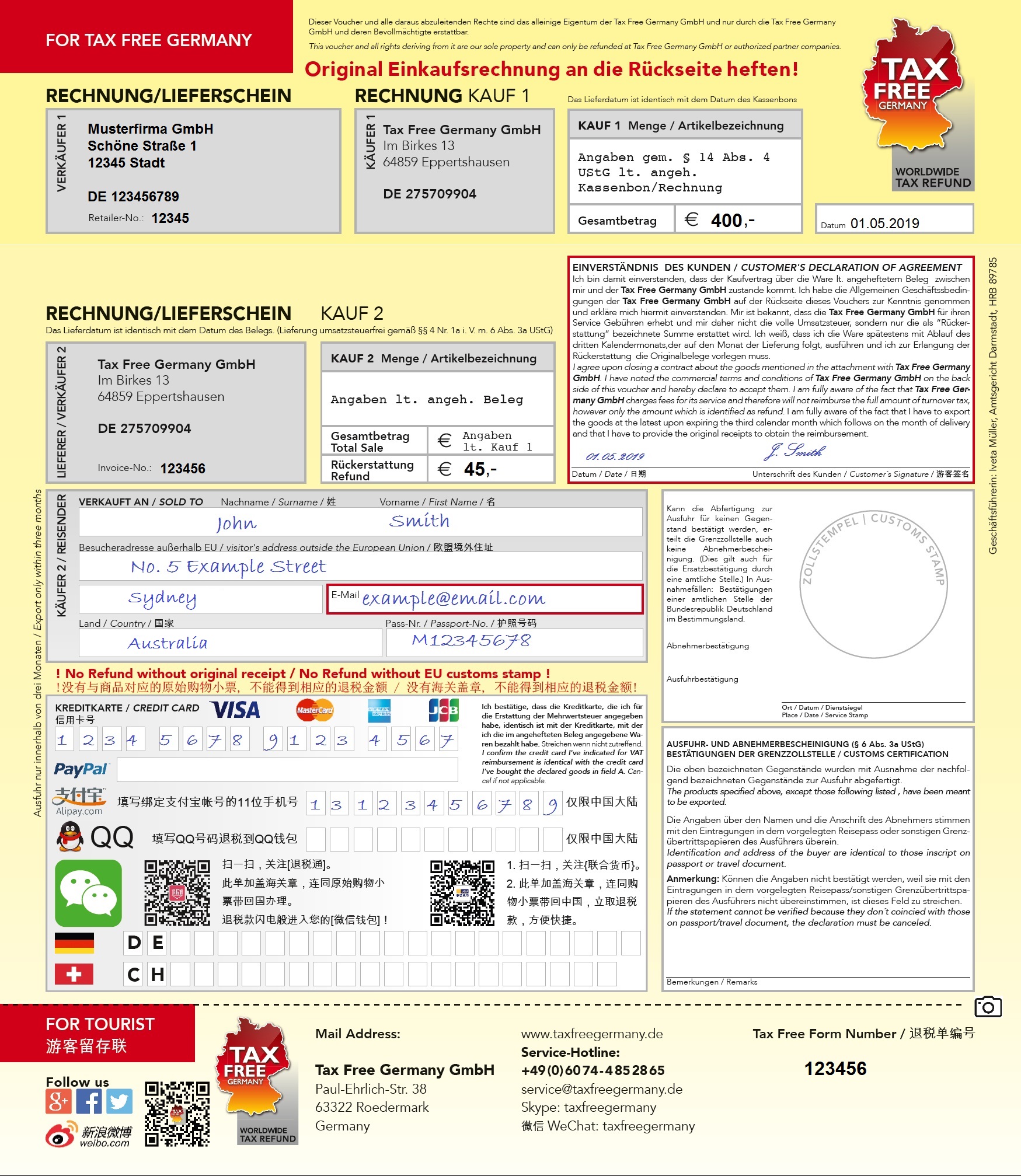

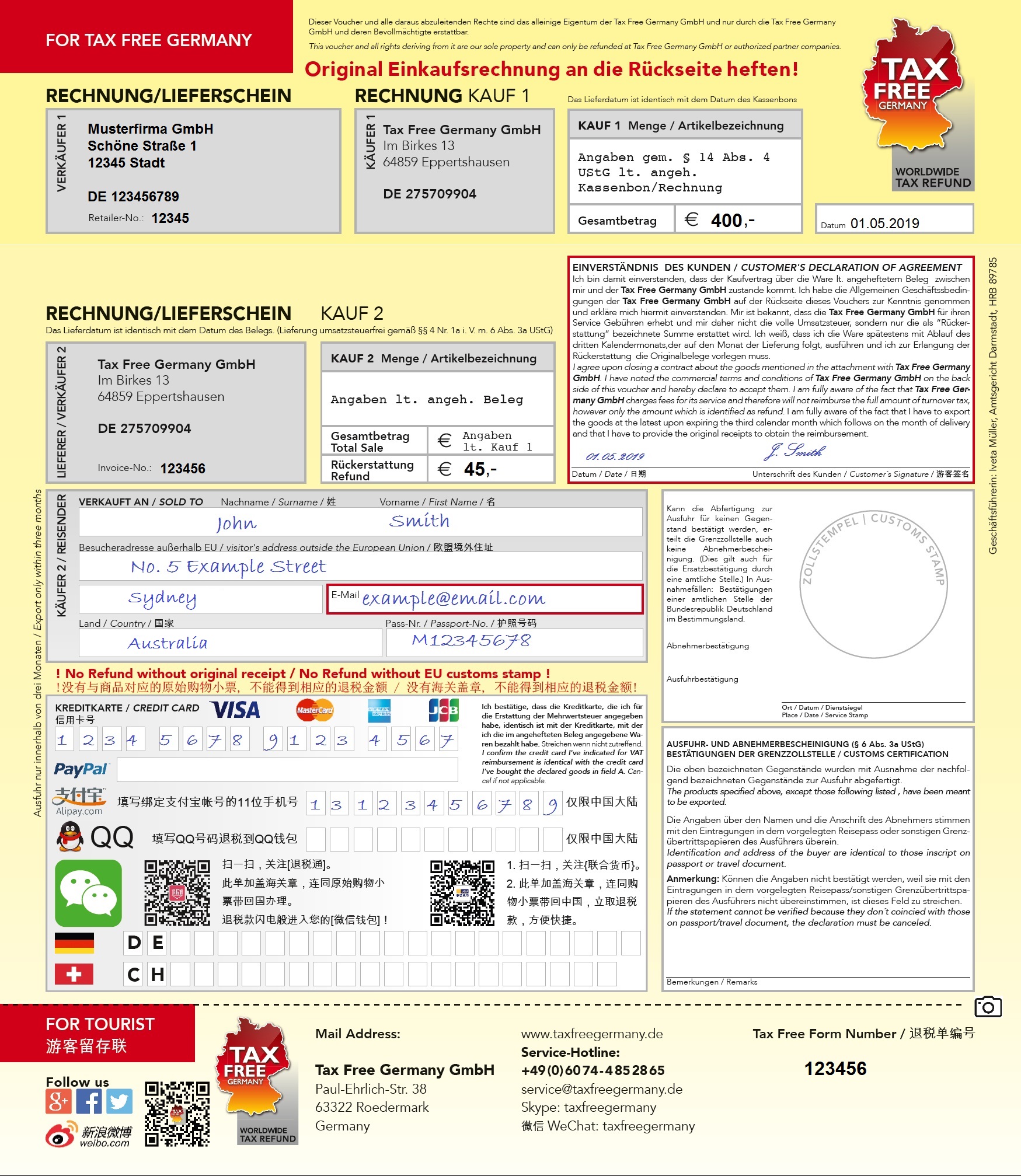

a. Full name and surname

b. Complete address and country, where you have your main residence

c. Passport number

d. Date and signature

e. If you wish to be paid by bank transfer , please give the necessary bank details

a. Full name and surname

b. Complete address and country, where you have your main residence

c. Passport number

d. Date and signature

e. If you wish to be paid by bank transfer , please give the necessary bank details

Yes, with the customs stamp the export of goods is confirmed and only then you may claim your tax refund from us or our partners.

The customs must confirm the export of goods. This you can do only at the last point at which you will leave the EU. Usually this is done at the airport or at the border, for example, Germany – Switzerland. You have to show the purchased goods, the Tax Free Germany voucher with the appropriate receipt and your passport to the competent customs office. The customs stamps confirming the export of the goods.

On the last point at which you leave the EU. Usually, this is done at the airport or at the border, for example, Germany-Switzerland.

You need to present the purchased goods, the Tax Free voucher together with the original invoice and your passport to the competent customs office.

a. Warning! When sending in the documents, we advise you to make a copy of your Tax Free documents or take a picture of it (the voucher, the original invoice and the envelope) and if necessary, to send by registered post.

b. Please send the stamped Tax Free voucher, completed with your data (address and signature) together with the original invoice , using the pre-franked envelope (which was handed out in the shops) to the Tax Free Germany headquarters. Please post the envelope only in a postal mailbox.

c. If you have no envelope of Tax Free Germany, please send the documents in a sufficiently stamped envelope to:

Tax Free Germany GmbH

Im Birkes 13

64859 Eppertshausen

GERMANY

a. At the airport on your departure, you can get cash immediately at the counters of our partners.

b. When submitting the documents by post, a credit to your credit card account is carried out according inbox within eight weeks.

c. If you have not receive the money after 2 months, please contact us.

The reimbursement is the VAT minus a processing fee. You can calculate this in our refund calculator (left).

No, from Tax Free Germany will be no additional cost in paying the refund at the airport.

3 months (i.e. before the third following month on the purchase has expired).

Look out for a Tax Free sticker on the door or on the window displays or in the cash desk area. You can also ask an employee over the counter.

a. Services provided in Germany (so you need to pay the German VAT, for example, bus or train rides, repairs, restaurant visits and hotel stays)

b. In respect of goods intended for fitting to or equipping from private vehicles of all kinds (e.g. bumpers, mirrors, tow rope, tire and first aid kit) and

c. Stores supplied of a vehicle, such as fuel, motor oil or care products.

No, because the goods has to be presented to the customs in their original packaging and in a perfect condition. Otherwise, the customs could refuse the certification of export of goods.

The Tax Free Germany service is free for the retailers. The processing fees are borne by the travelers.

a. Completely free service through which you can generate higher profits with your foreign customers.

b. TFG deals directly with the tax office about the VAT. Meaning, that the trader will not be charged by the VAT and thus carries no burden of proof and liability to the tax office.

c. No additional service fee in the payment at the airport.

d. The forms are very easy of handling (Tax Free voucher is only to be filled with the total amount and the refund amount!)

e. Free supply of working materials and advertising material.

f. Free training for your employees.

g. When seubmitting the documents by the tourists, a credit to their bank account or credit card account, is carried out according inbox after three working days.

a. At the airport, you may claim reimbursement at one of the Tax Free Germany cashier locations or

b. You can also send the stamped Tax Free voucher along with the original invoice by using the pre-franked envelope to the Tax Free Germany headquarters. For this, the bank account information of the tourists are needed for a transfer, and it must be filled in the voucher. A credit to a German bank account, credit card account, PayPal or Alipay is carried out according inbox after three working days.

Yes, the retailer can choose the Tax Free provider, which fits their demands. The retailer has this free capacity to act and freedom of choice. Tax Free service provider shall not conclude exclusive contracts.

As stated above, the retailer has free capacity to act and has freedom of choice and can also work simultaneously with multiple tax free providers.

No, the tourist can fill in the tax free form at the hotel or at the airport before the documents are brought to the customs to be stamped.

The tourist must perform the goods within 3 months (ie before the third following month on the purchase has expired) and the exportation of goods must be confirmed by the customs when leaving the EU.

The retailer should be convinced on a comprehensible manner, that the tourist is a non-EU citizen.

No, the tourist does not have to prove one's identity.

Yes, the customs confirms the export of goods, only then the tourists can have the value added tax they have been charged reimbursed.

No, because the goods must be presented to the customs in their original packaging and in a perfect condition. Otherwise, the customs could refuse the certification of exports of goods.

Yes, the goods have to be in the original packaging and in a perfect condition. Otherwise, the customs could refuse the certification of exports of goods.